by CLC Staff

A couple of great pieces of legislation not subject to this month’s Crossover deadline have caught our eye.

House Bill 146 calls for language to be included on the 2024 general election ballot that asks North Carolina’s voters if they agree with amending the state constitution to limit “the annual growth of the State budget to a percentage equal to the sum of annual inflation and the State’s annual population growth rate unless increased in a year in which two-thirds of both chambers of the General Assembly votes in favor of the increase.”

It’s called the “Taxpayer Protection Act” and it was sponsored by Representatives Dennis Riddell, Destin Hall, Erin Paré, and Jason Saine. If the majority of North Carolina’s 2024 voters approve the language, the General Assembly would be constitutionally bound to limit its spending of your tax dollars to no more than the combined rate of inflation and population growth — unless at least a two-thirds majority of both the state House and state Senate vote in favor of doing so.

Senate Bill 651 accelerates the reduction in our state’s personal income tax rate from the current rate of 4.6% to 3.99% next year and by 0.5% every year after that until the rate is reduced to 2.49% in 2027. It is a more ambitious plan than what the House’s budget calls for: a reduction from the current rate of 4.6% to 4.5%. The legislation was sponsored by Senate President ProTem Phil Berger and Senators Bill Rabon and Paul Newton.

Senate Releases its Budget Proposal

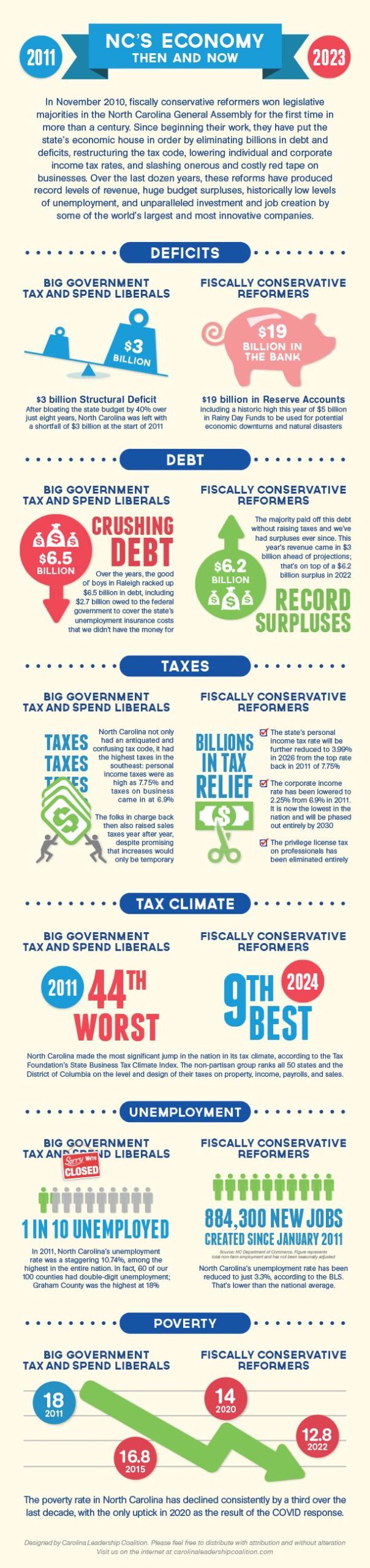

In other news, the Senate released its budget proposal on Monday. According to a press release from Senate Appropriations Chairs Brent Jackson, Ralph Hise, and Michael Lee, the plan calls for a net appropriation for FY 2023-24 of $29.8 billion and net appropriation for FY 2024-25 of $30.9 billion, the doubling of the state’s Stabilization and Inflationary Reserve with an increase of $900 million for a total of $1.9 billion, an increase of $250 million to the state’s Rainy Day Fund (for a total of $5 billion) and a total of $6.6 billion in tax reduction over the next five years.

The budget passed the Senate on Wednesday (36 to 13) with strong bipartisan support.

“This is a conservative budget that hits our spending target while aggressively cutting taxes and being good stewards of your tax dollars,” commented Senator Jackson. “We spend one-time funds on one-time needs and keep recurring costs in check. After more than a decade of responsible fiscal policy North Carolina remains on steady ground as we continue to face economic uncertainty.”

What else is in the Senate’s Budget Plan?

Education

- Spends over $17.2 billion on education in FY 2023-24 and over $17.6 billion in FY 2024-25

- Expands the Opportunity Scholarship Program to all families

- Increases funding for Opportunity Scholarship Grant Fund Reserve by $105 million in FY 2023-24 and $163 million in FY 2024-25

- Creates a new School Health Personnel Allotment and increases funding by $10 million recurring to help public K-12 schools hire around 120 more nurses, counselors, social workers, and psychologists

- Provides almost $70 million to develop and expand community college courses in high-demand career fields, including nursing and other health-related programs

- Supports North Carolina A&T in their efforts to become the first HBCU to obtain the R1 Carnegie Classification with an additional $10 million recurring in each fiscal year and $5 million non-recurring in the first fiscal year

Transportation

- Increases funding for the Strategic Transportation Investments Prioritization Program by $469.75 million in FY 2023-24 and $604.5 million in FY 2024-25 to help prioritize and fund large transportation projects across the state

- Provides an additional $75.6 million for contract resurfacing

- Spends over $400 million each year on the replacement and preservation of bridges

- Boosts funding for the General Maintenance Reserve, used to help with the upkeep of roads, by over $311 million

Salaries

- Appropriates $94 million into the Labor Market Adjustment Reserve (LMAR)

- Doubles the LMAR allocation to state agencies and community colleges to 2%

- Provides the UNC System with $15 million in LMAR funds

- State employees will receive a 5% pay raise over the biennium

- Teachers will receive an average raise of 4.5% over the biennium, and starting teacher pay will increase by nearly 11% over the same time period

- Average teacher pay will be $59,121 by the end of FY 2024-25, just under North Carolina’s median household income

- Nursing faculty at community colleges and the UNC System will receive a minimum 10% salary increase

- The State Highway Patrol, State Bureau of Investigation, and Alcohol Law Enforcement will get a 12% pay increase across the biennium

- Creates a pay scale for Juvenile Justice employees that aligns with the structure of the correctional officer salary schedule

Healthcare

- Enacts Medicaid expansion

- Appropriates the $1.5 billion of non-recurring funds from the federal “sign-on” bonus for expanding Medicaid, including:

- $370 million for NC Care Initiative between ECU and UNC Health systems that will feature the construction of 3 regional health clinics and rightsizing existing parts of their health systems

- $96 million for rural loan repayment incentive programs for primary care and behavioral health providers

- $60 million for start-up costs and expansion of healthcare programs at community colleges

- $20 million for UNC-Pembroke’s new healthcare-oriented programs

- Significant Certificate of Need reform, including repealing the CON requirements for mobile MRI machines, linear accelerators, physician office-based vascular access for hemodialysis, and kidney disease treatment centers

- Repeals CON for ambulatory surgical centers and facilities with MRI machines in counties with a population under 125,000 that do not have a hospital

- Includes $110 million to increase behavioral health provider rates on a recurring basis

- Allocates $60 million recurring each year for direct care worker wage increases

- Provides $50 million recurring to permanently retain half of the COVID-19 rate enhancement for skilled nursing facilities

- Increases Medicaid reimbursements for private duty nursing services from $45 per hour to $52 per hour

- Provides $15 million each year of the biennium for Free and Charitable Clinics to provide care to low-income families and individuals across the state

Other Items

- Allocates $1.4 billion, available for drawdown by NCInnovation, to improve applied research outputs at UNC System schools and to help commercialize the results of that research

- Directs the Economic Development Partnership of North Carolina to expand its study of megasites to include sites with fewer than 1,000 acres

- Provides $10 million in reserves to support local governments conduct their due diligence on the new megasites identified in the study funded last year, and making those sites shovel-ready

- Expands the post-election audit report to include a summary and detailed description of the results, and information on any items that could have affected the outcome of the election

- Includes an additional $35 million for the school safety grant program

- Increases funding for an anonymous tip-line which facilitates anonymous reporting of school safety threats

- Gives NC Emergency Management an additional $2.5 million in recurring funds to hire new support staff and to continue developing statewide school safety programs

- Includes $1 million for the N.C. National Guard to support the Joint Cybersecurity Response Force, which will partner with the National Guard and N.C. Emergency Management to combat cyber-attacks across the state

- Provides almost $19 million for a new N.C. Agriculture Manufacturing and Processing Initiative to incentivize the development of food processing facilities across the state

- Sets aside $20 million nonrecurring over the biennium for the N.C. Housing Trust Fund to provide housing for homeless veterans, victims of domestic violence, sexual assault, and human trafficking

As always, the Carolina Leadership Coalition looks forward to seeing the House and Senate compromise on these budget items. We’ll keep you posted.