By Patrick Gleason for Forbes

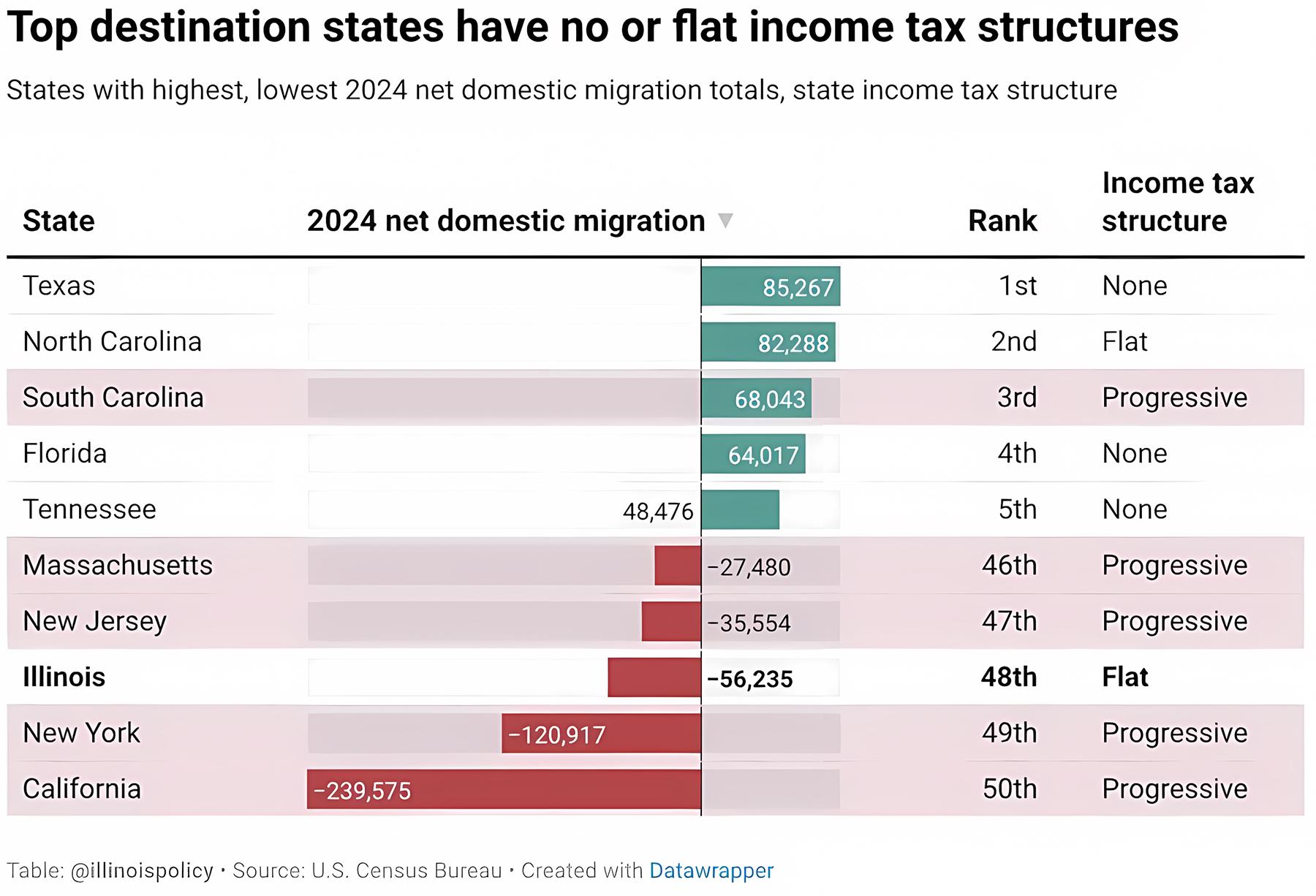

The U.S. Census Bureau produces data on net domestic migration that quantifies how many residents each state gained or lost every year through interstate migration. Bryce Hill, director of fiscal and economic research at the Illinois Policy Institute, recently highlighted noteworthy fiscal policy trends among the top gainers and losers.

Among the five states that lost the most population due to domestic net migration last year, “four of five have progressive state income taxes,” Hill noted in a February 26 post. “Illinois is the exception with its flat state income tax, but some state lawmakers are again trying to change that.”

Conversely, as Hill noted, among the five states that gained the most residents last year through domestic migration, four of them have either a flat income tax or no income tax. While Illinois is the outlier flat tax state among the top five population losers last year, South Carolina is the lone state with a progressive income tax among the five states that gained the most population through interstate migration in 2024.

While legislative leaders in Illinois would like to move from a flat to progressive income tax system, their counterparts in the South Carolina statehouse are interested in doing the opposite. South Carolina House Speaker Murrell Smith (R), Governor Henry McMaster (R), and leading members of the South Carolina Senate have expressed a desire to enact further income tax rate reduction this year that moves the state from a progressive income tax code with a top rate of 6.2% today to a single rate income tax below 4%.

Recent developments in other states, including many that already boast lower income tax rates than South Carolina, demonstrate why Palmetto State lawmakers are prudent to pursue income tax rate reduction. The Mississippi Senate, for example, will soon hold a floor vote on a bill cutting the state’s 4% flat income tax rate to 2.99% over the next four years.

The Mississippi House of Representatives, meanwhile, has already approved their own tax package this year, one that would fully phase out the state income tax, making Mississippi the nation’s ninth no-income-tax state. As legislators in Jackson prepare to work out the differences between the House and Senate tax cut plans over the next month, Governor Tate Reeves (R) recently expressed his preference for the House proposal and a belief that the Senate plan doesn’t go far enough.

“It doesn’t get anywhere near eliminating the income tax so it is a non-starter for me!,” Governor Reeves wrote about the Senate tax bill, adding “I’m beginning to believe that there is someone in the Senate that is philosophically opposed to eliminating the income tax.”

Nearby in Missouri, Governor Mike Kehoe (R) has also expressed support for phasing out the state income tax. Lawmakers in the Missouri House and Senate, meanwhile, have filed legislation cut the state’s top marginal income tax rate from 4.8% to 4%, with further rate reduction contingent upon revenue triggers being met in the coming years.

Beyond Missouri and Mississippi, income tax cuts have been enacted or are poised for passage in many other states this spring. Meanwhile in North Carolina, which kicked off more than a decade of state income tax rate reduction nationwide in 2013, new evidence has emerged that the multiple rounds of income tax relief enacted there are paying economic dividends.

In a recent blog post by the John Locke Foundation, Brian Balfour, the Raleigh-based think tank’s senior vice president of research, touts a new report from a Democratic-led state department as further proof that the income tax cuts enacted since 2013 are benefitting all North Carolinians, not just the rich as critics contend.

“A new report released by the NC Department of Commerce now shows that the tax cuts of the past dozen years helped to lift hundreds of thousands of North Carolinians out of poverty and reduce poverty at one of the fastest rates in the country,” Balfour wrote.

“North Carolina’s poverty rate declined from 17.8% in 2013 to 12.8% in 2023, a decrease of five percentage points over the decade,” the North Carolina Department of Commerce noted in its report. “The state’s progress ranks fifth nationwide in poverty reduction during this period.”

“This reduction in poverty, according to the report,” Balfour noted, “represents roughly 360,000 fewer individuals below the poverty line.”

“The critics of tax cuts have for more than a decade wrongly warned us about massive budget shortfalls due to tax cuts, and now a new report confirms that they are wrong about tax cuts exclusively helping ‘the rich’ and big corporations,” Balfour added.

Residents of nine states had a state income tax take effect on the first day of 2025. Based on recent activity in state capitals, income tax rates in many will drop further on New Years Day 2026.

The preceding article originally appeared on February 28, 2025 at Forbes’ website and is made available here for educational purposes only. This constitutes a ‘fair use’ of any such copyrighted material as provided for in Title 17 U.S.C. section 106A-117 of the U.S. Copyright Law. Any views or opinions expressed here are those of the authors and do not necessarily reflect the official policy or position of the Carolina Leadership Coalition.