by CLC Staff

At a press conference yesterday afternoon, House leaders unveiled their nearly $30 billion budget plan for the upcoming fiscal year. The proposal contains double-digit pay increases for public school teachers and other state employees while further cutting the individual income tax rate and taxes on businesses.

“This is a budget that invests in our state employees, teachers, infrastructure and workforce development,” said Speaker of the House Tim Moore. “This budget balances the needs of a state with a growing economy, while maintaining a sustainable spending path.”

Teachers would see a 4.25 percent pay raise in the first year of the biennium followed by a 3.25 percent increase in the second. Money will also be set aside to address the growing need in hard-to-recruit and hard-to-retain positions, roughly an additional 2 percent. Under the House plan, average teacher pay in North Carolina would increase to $62,650 — the highest in the southeast and more than $8,000 higher than Georgia, the next highest state.

An additional $70 million has been set aside for pay supplements for teachers in low-wealth and rural areas. “Adding all of the teacher compensation together,” Speaker Moore continued, “including the steps that are built in, the additional added pay that’s in place for those rural areas, and then the pay raise as mentioned earlier, that’s going to be over 10 percent of a pay raise for our teachers in North Carolina over the biennium.”

Community colleges will see an additional $25.9 million above and beyond their pay increases, which they can use to retain and to recruit faculty. Moore cited the need for nursing instructors: “We know there’s been a shortage of nursing instructors around the state, and so that’s going to allow the community colleges to catch up and to make sure that we have those folks working there.”

House Bill 259 also calls for $3.6 billion in infrastructure spending, as well as another $2 billion for water and sewer system projects across the state — “particularly (in) a lot of our rural areas where we now see a lot of new industry locating, where they didn’t necessarily have the infrastructure and they’re going to need the infrastructure to bring in those new jobs,” Moore continued.

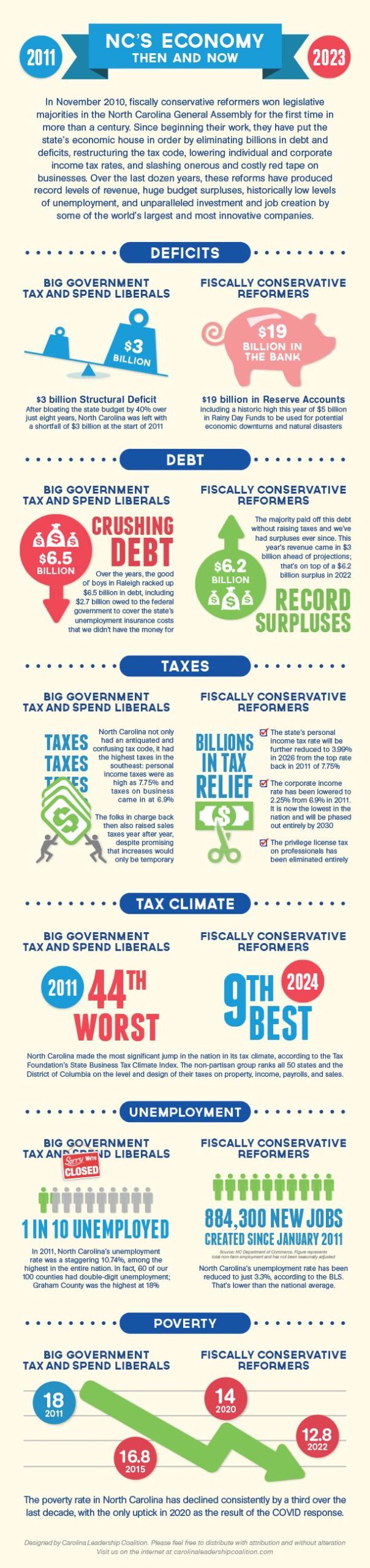

Speaker Moore credited North Carolina’s strong economy and its fiscally conservative policies with providing the environment for the growth in spending — 6.5% in the first year and 3.75% in the second — which is still under what the revenue the state expects to take in. This year’s revenue is forecasted at $33.7 billion.

“North Carolina is in an amazing position,” summed up Speaker Moore. “It’s in some of the best financial condition that it’s been in any of our lifetimes. It’s one of the most fiscally sound states in the nation. It’s not an accident that companies around the world recognize that North Carolina is the premier state to locate new businesses, to expand, and to keep businesses where they already are. It’s no accident, and it’s a result of hard work over many years now of lowering taxes, reducing regulations, and investing the tax revenue into the right services.”

Speaker Moore was joined at the press conference by various Appropriations subcommittee chairmen, who each spoke to the component parts of the budget. They included: Representative Donny Lambeth (health), Representative Dean Arp (capital projects and the infrastructure), Representative Jeffrey Elmore (Education), Representative Brenden Jones (transportation and justice & public safety), Representative Larry Strickland (workforce development), Representative Kyle Hall (agriculture and natural & economic resources), Representative John Bradford (finance), and Representative Jason Saine (economic development and information technology. What follows below is a transcript of their remarks.

Representative Donny Lambeth

“Healthcare has certainly drawn a lot of attention this session, and we’re actually very proud to say that we’ve been listening to many of the providers. We know there are some challenges out there in the healthcare field and we’ve tried to respond to those as we’ve learned more and dug deeper into some of their challenges. I’m just going to share a couple of the highlights because there’s a lot in the healthcare section that you may have questions for later, but I’m just going to touch on a couple of high-level topics.

“We know our skilled nursing sector is struggling, so we’ve added $170.5 million in recurring spending in each of the years to permanently maintain the Medicaid rates for the nursing homes and to increase the Medicaid rates for personal care services to $25 an hour.

“We’ve added $60 million in each year to increase the wage of direct care workers providing services to individuals with intellectual and developmental disabilities (IDD) who are on the Medicaid Innovations Waiver Program.

“We’ve added $24 million recurring funds along with one-time COVID relief funds for an increase in the federal block grant funding, which will allow the state to increase the reimbursement rates for subsidizing our childcare.

“We’ve added $15 million each year to expand the communicable disease testing, surveillance, detection, control, and prevention at our local health departments. This is really pretty creative, too. We’ve added $5.1 million, recurring and $10.2 million recurring in the second year for assistance payments to families caring for a relative in foster care and to encourage them to become foster licensed parents.

“We’ve heard clearly that we have got some foster care challenges and we’re continuing to look at ways to improve that. I would also tell you that the budget does include $1.64 billion that will be allocated in key areas from the Medicaid incentive money that we’ll get over the eight quarters. A significant amount of that money will go to mental health reform, but a couple of things I would like to point out. There’ll be a $25 million rural hospital stabilization program. We continue to be concerned about our rural hospitals. We want to support them in any way we can to keep them operating in their communities and grow and this is a way that we can do that.

“We’re also obviously concerned about access and we’ve got $50 million in loan forgiveness programs to incentivize individuals, physicians, nurses, nurse practitioners, to go into many of our rural communities. This is a fairly creative loan forgiveness program that will help them hopefully recruit and retain individuals in their communities to provide better healthcare at a local level rather than having to refer so many out of their communities.”

Representative Dean Arp

“This budget continues the bold investments that this state — because of our strong financial position — makes in infrastructure and capital projects and so forth. Just to give you an idea, this year alone, we will invest over the biennium over $3.6 billion in cash. That’s not borrowing, that’s not taking out a mortgage in our children’s future. That’s cash associated to invest in the critical infrastructure and needs to continue to grow our state and the facilities that we need.

“On top of that, over four years, the next biennium, that’s $6 billion that we plan to spend and invest in our infrastructure for North Carolina. In addition to those buildings and repairs and renovation and things, we’re going to invest $2 billion for water and sewer. It’s a wildly popular project that we have started in partnerships for local water and sewer projects. This budget continues to do that.

“This budget also invests over $900 million — almost a billion dollars — in school capital construction over the biennium. We continue to invest in our grant program for needy areas and this program will do almost a billion dollars for that over the next two years.”

Representative Jeffrey Elmore

“It’s very exciting with the education budget, with the programming dollars. The major focus was workforce development and how do we develop workers for these hard-to-staff jobs — and especially with the expansion of Medicaid — how do we inject needed healthcare workers all over the state. We’ve always believed that the quickest way to do that is through our community college system. This budget, you’re going to see over $120 million invested in workforce programs ranging from startup monies for high-cost programs at the community college to covering the cost of short-term workforce programs for the student to where you can participate in those programs at no cost at all. Also, we figured out a recurring spot for the Longleaf Commitment Community College Grant of $25 million to where that program can stay permanent to where that is tuition free for folks attending the community college.

“Another exciting thing that we’re doing is in K-12. The transition from third grade to fourth grade is very difficult for many of our students because up to third grade, we have class size restrictions. The student may be in a classroom of 14, 15 children, but then they get to a fourth grade classroom where there can be as many as 30, 32 kids. What we’re seeing is a reflection of our proficiency in math at that age is when it starts dropping off. You’re going to see some language to help work on our math proficiencies and to also aid in that we’re capping the class size at fourth grade and not allowing it to go over 24 students and also providing funding to allow for teachers assistants in fourth grade classrooms to help with that initiative.

“We also are committed to our school safety grant program. It’s been very popular and we are putting in an investment of $40 million into that fund so the schools can continue to apply to get safety equipment, safety training in our schools.

“For our university level, we are investing $60 million over the biennium in dealing with developing healthcare-related programming at our universities to get the healthcare workers that we need.

“We also have a $17.5 million investment in our engineering North Carolina’s future… the development of our engineering programs at NC State, UNC Charlotte, North Carolina A&T.

“A couple of exciting provisions: we are expanding the eligibility for the Teaching Fellows program. We see that we are having some staffing issues, not just in STEM areas, but across all areas of teaching. I’ve taught for 23 years and we’re now seeing problems finding even elementary ed and that has not been seen in my entire working career. We feel like the Teaching Fellows Program could be, not a silver bullet, but a part of helping with that so we’re expanding the eligibility in all subject areas, also expanding that to all of our state universities, and also including four private institutions to be able to participate in that program.

“We also expand the eligibility for choice in this budget. We’re expanding the eligibility of the Opportunity Scholarship Program by removing the requirement that a student must attend a public school prior to receiving an award from grades three through eight. Currently, the program does that through grades K2, but that will expand that to K8 and we also back that up with an additional $56 million appropriation to be able to take care of that change in policy.”

Representative Brenden Jones

“Thank you everyone for being here today. I would like to say that we’re putting monumental monies into our transportation needs as well as our JPS (Justice and Public Safety). We have some of the finest police agencies in this nation and our guys and ladies deserve everything that we can do for them.

“We’re second only to Texas in the number of paved roads in this state and the number one state in the nation for growth. We’ve got a lot of infrastructure needs and a lot of resurfacing needs and we have addressed that with this budget.

“$8.7 million will go for operations for the juvenile justice facilities and $20 million in local law enforcement grants; we’re going to transfer the State Crime Lab to the State Bureau of Investigation; 17.5 percent raises for State Highway Patrol, including the step increases; establish the State Bureau of Investigations as a new principle department; $3.5 million non-recurring to implement the voter identification requirements enacted in 2018; eliminate the recurring funding and prohibit the State Board of Elections from joining ERIC (Electronic Registration Information Center).

“On transportation, there’s so much we could get into, but just a couple of the highlights there. $1.3 billion and non-recurring to the General Maintenance Reserve for road maintenance. This is something new: increase the driver’s license renewal period from 8 years to 16 years for drivers between the ages of 18 and 66 and allow unlimited online renewal for drivers meeting certain criteria. Also, we will be investing $300 million for general aviation products, modernizing our rural airports, which is huge for this state.”

Representative Larry Strickland

“Our house budget makes significant commitments to workforce development for our state: over $200 million over the biennium in workforce development investments across commerce, health and human services. $70 million across the biennium from the housing reserve for workforce housing loan programs and waivers. All state registration fees for courses that lead to a workforce accreditation while increasing financial aid for students seeking an associate degree.”

Representative Kyle Hall

The Agriculture Natural and Economic Resources portion of the budget, as Chairman Arp has already mentioned once already, we’ve invested $2 billion over the biennium for water, wastewater and stormwater grants, $130 million for parks, trails and land preservation grants, $469.1 million for economic development and $4.1 million to address emerging compounds in the environment. To go a little deeper in there, we also for the Department of Agriculture have invested $15 million into the farmland preservation account and the Department of Environmental Quality.

“We continue to invest in our emerging compounds department over there by giving another $4 million recurring and $584,000 non-recurring for 24 new positions to address emerging compounds such as PFAS. The Department of Natural and Cultural Resources, we’ve invested $3.5 million recurring into local arts grants to our local arts councils. We have increased our funding to our local libraries, grants up to $20 million recurring.

“Another big part that conservation groups should all be proud of is we have invested heavily into our parks and recreation trust fund as well as our North Carolina Land and Water Fund. We have given them $30 million ($20 million non-recurring in the first year of the biennium).”

Representative John Bradford

“It’s my honor to talk about our finance tax package in the budget. Over the biennium, we plan on cutting just shy of $700 million across personal income tax, business-related and sales taxes. For today’s event here, I’m just going to really focus on the personal income tax because as we probably all know, we’re a flat-tax state and that helps all wage earners in North Carolina. Of the approximately $700 million in cuts, $500 million is coming out of personal income tax across the biennium, so we’re going to accelerate the rate that was going to be scheduled for 2025 and we’re going to bring that forward. What was going to be 4.6 is now going to go down to 4.5, so we’re actually accelerating what we had planned on last budget by a year. We’re also going to increase the standard deduction for married filing jointly as well as increasing it by 20 percent beginning in 2024 for the trial deduction. The last thing I’ll talk about while there are many others, just for highlights here, a refundable adoption tax credit of $2,000 per child, which we think is very, very important. We’re excited to deliver those things to you today.”

Representative Jason Saine

“I really appreciate the opportunity to tell you the highlights we have in the budget about economic development. It is exciting when you’re in a state that continues to grow, that continues to be attractive to companies from not just within North Carolina that are growing and the homegrown and the ‘mom and pops’ that are doing well, but also those companies that are looking at us as they move from states with high taxes and poor economic development choices to a state that’s making good economic development choices. In the economic development package we’ve got $469.1 million for economic development, $22.5 million non-recurring in the first year of the biennium, and $12.5 million non-recurring in the second for vocational training.

“Workforce grants, even though it’s great to recruit companies, you’ve got to have that workforce so that they’ll be there to be employed. $150 million non-recurring each year of the biennium for the Megasites Readiness Program. As you know, our megasites are filling up and we must have inventory, so we’re looking to the future and making sure that we’re designing those and looking at those so that we’ll have places for the next big win. $50 million non-recurring each year for the Select Sites Readiness Program. Also something for the small counties, too. It’s one thing if you’ve got a megasite, it’s one thing if you’ve got a lot of population, but also recruiting those smaller companies, too. We’ve got a program that we’re piloting out $15 million in non-recurring, and $10 million to develop a Shell Site Program so that we can help those counties develop those shell buildings so that not only do they have property, but they may be short on funds to develop those shell buildings so we’re going to help with that as well. We think that’ll be a pretty exciting thing if it works and we think it will work. We’ll do a lot more of that as we continue to grow in North Carolina.

“Looking at IT, some of the major highlights of the information technology budget include $7 million in the first year of the biennium for the Government Data Analytics Center to conduct a proof of concept for the My Future NC Workforce. The proposed budget has about 0.2 million in each year for the biennium study to be conducted on the feasibility of modernizing the Department of Motor Vehicles. I know that’s something that we’re all concerned about when we renew our licenses and interact with the DMV. A lot of other things in IT: cybersecurity, things that you would expect, things we’re doing on broadband, but just continuing on the successes that we’ve experienced in the past and we continue to grow.”