by CLC Staff

The House’s state budget proposal made its first of two committee stops today on its way to a full vote on the floor, expected tomorrow (session reumes at 2pm and will be livestreamed here). Representative John Bradford, a Senior Chairman of the House Finance Committee, presented his colleagues with the finance-related components of House Bill 259, the 2023 Appropriations Act.

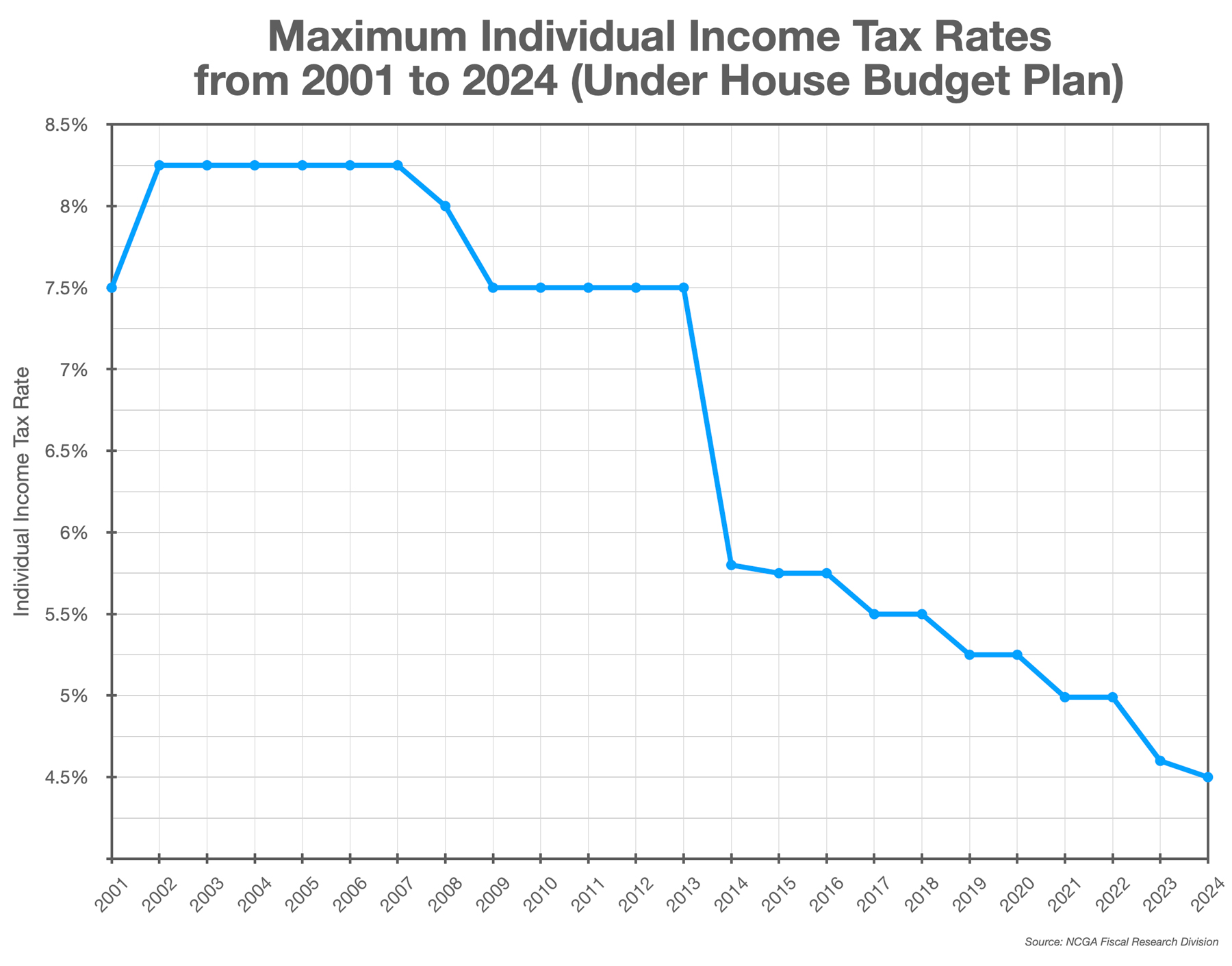

Altogether, the House plan calls for approximately $700 million in tax cuts, nearly three-quarters of which come from a reduction in the individual income tax rate. That reduction, from the current rate of 4.6% to 4.5%, was originally scheduled for the 2025 tax year. It will instead take effect next year, according to the House proposal.

Since 2013, the conservative majority in the General Assembly has incrementally lowered individual income tax rates from their high of 8.25% in 2007.

The House plan also calls for a $500 increase in the standard deduction, from the current $25,500 to $26,000.

The standard deduction reduces the amount of income on which you’re taxed. For example, if you and your spouse made a combined $30,000 a year in 2011 (when the standard deduction was just $6,000), you’d have paid state income taxes on $24,000 of that ($30,000 – $6,000 = $24,000). Over the last decade of conservative reforms, the standard deduction has been gradually increased to the current $25,500 — meaning that if the numbers hold in the House version of the budget, you and your spouse would only be taxed on just $4,000 of that same $30,000 in combined income ($30,000 – $26,000 = $4,000).

Under the proposal, the standard deduction for heads-of-household would increase from $19,125 to $19,500 and the standard deduction for single filers would increase from $12,750 to $13,000.

There is also a 20% increase for the per-child deduction from the current maximum of $3,000 to $3,600.

The House budget also calls for two new refundable tax credits: a $2,000 maximum tax credit per child to help offset the costs and fees related to the adoption process, and a $5,000 maximum tax credit to offset any expenses related to the donation of organs and bone marrow.

Unlike a deduction, which reduces the amount of one’s income that is taxed, a tax credit is a dollar-for-dollar reduction of the income tax one owes. For example, if one ends up owing $3,000 in state taxes but is eligible for $3,000 in tax credits, one’s net liability drops to zero.

Business taxes

While there will be no reduction of the current 2.5% corporate income tax next year under the House plan (it is, however, scheduled to be phased out entirely by 2030), the Franchise Tax Rate is decreased from $1.50 per $1,000 to $1.00 per $1,000 over the next five years.

Unlike the corporate income tax, which taxes profit after it is made, franchise taxes on businesses are charged prospectively for the “privilege” of doing business in a state — whether they are profitable or not. Franchise taxes are calculated essentially on net worth, which includes both tangible assets (e.g. property, equipment, facilities, land) and intangible assets (e.g. trademarks and patents) which are held in-state.

In 2020, CLC commissioned a study from The Beacon Hill Institute calling for the elimination of the franchise tax in North Carolina.

“Levied in addition to the corporate income tax, the franchise tax presents a duplicative tax that, in recent years, has hit our state’s businesses almost as hard as the corporate tax – $646 million in 2020, compared to $657.8 million in corporate revenues,” said the North Carolina Chamber of Commerce in a statement last year, agreeing with CLC. “Eliminating this tax would result in direct bottom-line savings for the vast majority of job creators throughout the state.”

Only five other states currently levy franchise taxes.

The budget plan does repeal the Privilege License Tax on Professionals (typically $50 per year after application fees), effective this year. This includes such professions as veterinarians, osteopaths, chiropractors, chiropodists, ophthalmologists, massage therapists, land surveyors, architects, photographers, real estate agents, home inspectors, and funeral directors. For more information on the hundreds of business, occupational, and privilege licenses issued in North Carolina, pop on over to the North Carolina Department of Commerce’s Business & Occupational License Database.