By CLC Staff

Last month, the Wall Street Journal reported that Elliott Management Corporation, one of the oldest and wealthiest hedge funds in the world, had acquired a stake in Duke Energy.

Duke, headquartered in Charlotte, provides electricity to nearly eight million customers spanning six states: North Carolina, South Carolina, Ohio, Kentucky, Indiana, and Florida. It is the third largest energy provider in the world with a valuation of $79 billion and generates $25 billion in revenue each year. Employing 29,000 people, Duke Energy is on Fortune Magazine’s list of the “World’s Most Admired Companies” and Forbes’ list of “America’s Best Large Employers.”

A week after the story in the Journal broke, Elliott Management sent a concerning letter to Duke’s Board of Directors calling on them to form an independent review committee to look at splitting the company into three regionally-based companies (the Carolinas, Florida and the Midwest) — a move the hedge fund said would unlock $15 billion in value for Duke’s shareholders.

“Duke’s “long-term underperformance has not been reflective of its high-quality assets and that the company should explore a separation to increase operational focus and improve performance,” said the letter.

Duke responded to Elliott Management the same day. The board said that while “the company is always open to new ideas to create growth and value,” the proposal was just “the latest in a series of proposals that the hedge fund has offered to Duke Energy since July 2020.” The board determined that those prior proposals were “not in the best interests of the company, its shareholders and other stakeholders.”

Generally addressing the concept of breaking apart the company, Duke’s board pointed out that the “shrink-the company strategy that underlies all of Elliott’s proposals runs counter to the strategic direction of the entire industry at a time when scale is needed to efficiently finance the company’s unprecedented capital investment and growth opportunities.”

State leaders were quick to urge caution as well. In a rare, bipartisan joint statement from North Carolina’s Governor Roy Cooper, House Speaker Tim Moore, House Minority Leader Representative Robert Reives, Senate President Pro Tempore Phil Berger and Senate Minority Leader Dan Blue, they said:

“We’re proud that North Carolina is headquarters to Duke Energy and of the thousands of jobs it provides. For more than a century, Duke has been a valued member of our business community and we appreciate working with them on issues ranging from economic development and inclement weather response to a clean energy future for North Carolina.

“Beyond the pride of a home-state company, though, is the reality that Duke delivers reliable, cost-effective energy to millions of North Carolinians. There are natural concerns that come with putting our state’s energy future in the hands of a Wall Street hedge fund, and we would expect the North Carolina Utilities Commission to strictly scrutinize any such arrangement.

“As our state emerges from this pandemic growing and attracting thousands of good new jobs, it is more important than ever for North Carolina to have a strong, independent, in-state utility.”

For his part, South Carolina Gov. Henry McMaster wrote a letter to Duke chief executive Lynn Good saying that Duke should remain an independent company headquartered in the Carolinas:

“Earlier this week it was reported that a Wall Street hedge fund had acquired a large shareholder stake in Duke Energy with plans to force substantial changes at the company,” McMaster said. “I believe that it is in the best interest of South Carolina ratepayers for Duke Energy to remain an independent company headquartered in the Carolinas.”

So What is a Hedge Fund, Anyway?

According to the U.S. Securities and Exchange Commission (SEC), hedge funds “pool money from investors and invest in securities or other types of investments with the goal of getting positive returns. Hedge funds are not regulated as heavily as mutual funds and generally have more leeway than mutual funds to pursue investments and strategies that may increase the risk of investment losses. Hedge funds are limited to wealthier investors who can afford the higher fees and risks of hedge fund investing, and institutional investors, including pension funds.”

Boring language, to be sure. But this short Marketplace APM video explains it well.

Hedge funds are only open to accredited investors, those individuals with annual incomes that exceed $200,000 or have a net worth exceeding $1 million (excluding their primary residence). Hedge funds can invest in anything (e.g. real estate, fine art, sovereign debt, stock, derivatives, and international currencies). Employing various strategies (including “hedging” their bets), hedge funds seek to create regular “alpha” for their investors. Alpha is basically the percentage by which a portfolio outperforms (or underperforms) a market index like the Nasdaq, Down Jones Industrial Average, and the Standard & Poor’s 500. The higher the alpha, the better. It represents the return in excess of what the benchmark would otherwise predict, and reflects the value that the hedge fund’s management brings its portfolio. Alpha can also be negative, which would indicate a portfolio mix that generates less value than the larger market.

Activist Investors

Elliott Management is the nation’s largest activist hedge fund. Activist investors, who typically have substantial business expertise, see financial opportunity in what they believe to be undervalued, publicly-traded companies. To make money, the activist investor snaps up a significant stake in the company they target with the intention of making fundamental changes to how it is run. Ostensibly, the idea is to reduce costs and improve efficiency, therefore maximizing profits and increasing shareholders’ wealth.

These big changes can include selling off underperforming units, spinning-off unrelated businesses, returning large amounts of cash to stockholders through stock buybacks or issuing dividends, firing employees, and even selling off the company entirely.

Pass the Breadsticks Please

But the changes can occur in smaller ways too. In 2019, activist hedge fund Starboard Value took over Darden Restaurants, the owner of Olive Garden. Starboard argued that Olive Garden’s policy of giving away too many free breadsticks led to waste. “Darden management readily admits that after sitting just 7 minutes, the breadsticks deteriorate in quality,” Starboard said in a 300 page report.

The new breadstick policy (which also included a new recipe) and other streamlining measures, led to increased sales and a 47 percent gain in the value of the company’s stock.

Making the Move

The amount of stock that activist investors need to influence corporate policy need not be large. In 2019, Starboard gained near-total control of Cerner Corporation, a firm that specializes in healthcare information technology services and devices, despite owning only 1.2% of its outstanding shares. “One indication a company has become a target for activist investors is the filing of a Schedule 13D with the Securities and Exchange Commission,” reports Will Kenton of Investopedia. It “is required when an investor acquires 5% or more of a company’s voting class shares.”

The trick for the activist investor is to get enough fellow shareholders to agree to the changes. Because it is ultimately the company’s board of directors that make these kinds of decisions, it is the goal of the activist investor to control enough of its board. (According to a report by Lazard Asset Management, a leading financial advisory firm, Elliott managed to win 13 board seats of companies it was targeting in 2020, second only to Starboard Value. Together, they accounted for nearly one-third of all the board seats won that year.) This is accomplished by the activist investor and his allies mounting a campaign in the media, which usually starts with a public announcement that substantial shares have been acquired: the hedge fund billionaire Carl Icahn famously Tweeted his purchase of Apple shares in the summer of 2013; within an hour, the stock was worth an additional $17 billion.

The same thing has not happened with Duke’s stock. After posting an initial 4.8% gain after The Wall Street Journal broke the news on May 10, shares have changed little in the last few weeks — an indication that Wall Street might not agree with Elliott Management’s restructuring of Duke.

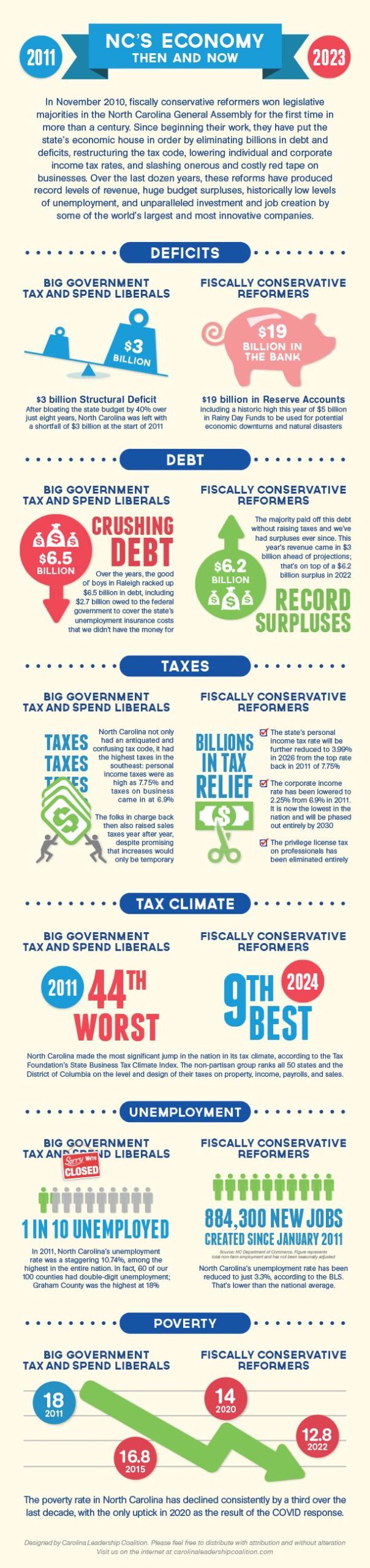

Duke Energy’s roots extend back over a century in North Carolina; the Carolina Leadership Coalition joins with Governor Cooper and other state leaders in voicing our concern regarding the potential hostile takeover of Duke by an out-of-state hedge fund.