The Business North Carolina economic forecast panel convened in early January at the Campbell University Law School in downtown Raleigh to discuss the state’s economy and where it’s headed. Unlike last year, when many predicted a recession for 2023, the panelists believe that the current year will see slower growth, but no recession. The state is well positioned to weather any economic headwinds.

The discussion was sponsored by: Brooks Pierce, Campbell University, First Bank (FBNC), Humphrey & Leonard LLP, McLendon, and UnitedHealthcare

Chris Roush, executive editor of Business North Carolina, moderated the discussion. It was edited for brevity and clarity.

What Do You See Happening With The Economy In 2024?

Dr. Mark Steckbeck, MD: I’m Dr. Mark Steckbeck, associate professor of economics at Campbell University, and the Lundy Chair of Business Philosophy. A lot of people are saying the Fed is probably gonna lower rates this year, maybe a little. I still think they’re gonna hold steady this year at 5.3%. I really don’t see them making much of a change. And the reason for that is we do see inflation going down, but we still see wage inflation. We still see housing prices are up. They are coming down considerably, but they’re still up over some longer term trends.

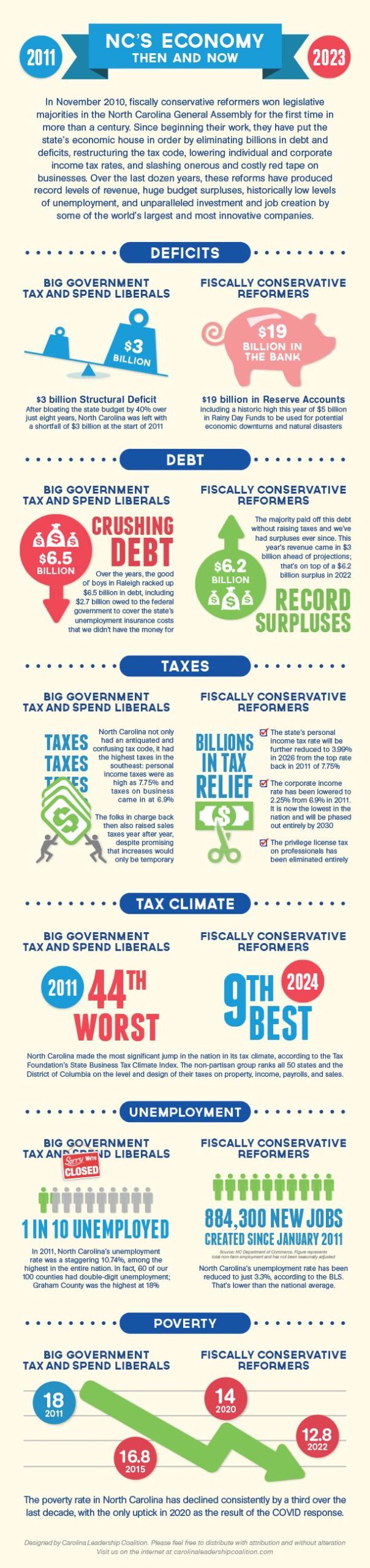

North Carolina has actually done pretty well. We have an unemployment rate of 3.4%, which is half a percentage point less than the U.S. as a whole. Wages are still higher or higher than the Feds average that they’re looking for but still doing pretty well. Manufacturing is one of the hardest–hit labor sectors in this state. But it’s also poised to really rebound a lot with getting the Toyota plant, things like that. The biggest change is going to be in education and healthcare, those areas are going to have a larger increase in labor employment.

One of the things I really want to look at moving forward with these projections are a couple things that I would be a little concerned with. The first one is leading indexes. For North Carolina, it’s actually a big positive. Whether it’s manufacturing, the initial applications for unemployment, those have been up. North Carolina is actually doing really well with that.

I put about a 20% chance of a resurgence in inflation. And if that happens, the Fed is going to further raise interest rates. I don’t think that’s going to be a significant indicator. I think moving forward, I don’t see a recession, especially with the economic development going on.

Read the entire article on BusinessNC’s website.