by CLC Staff

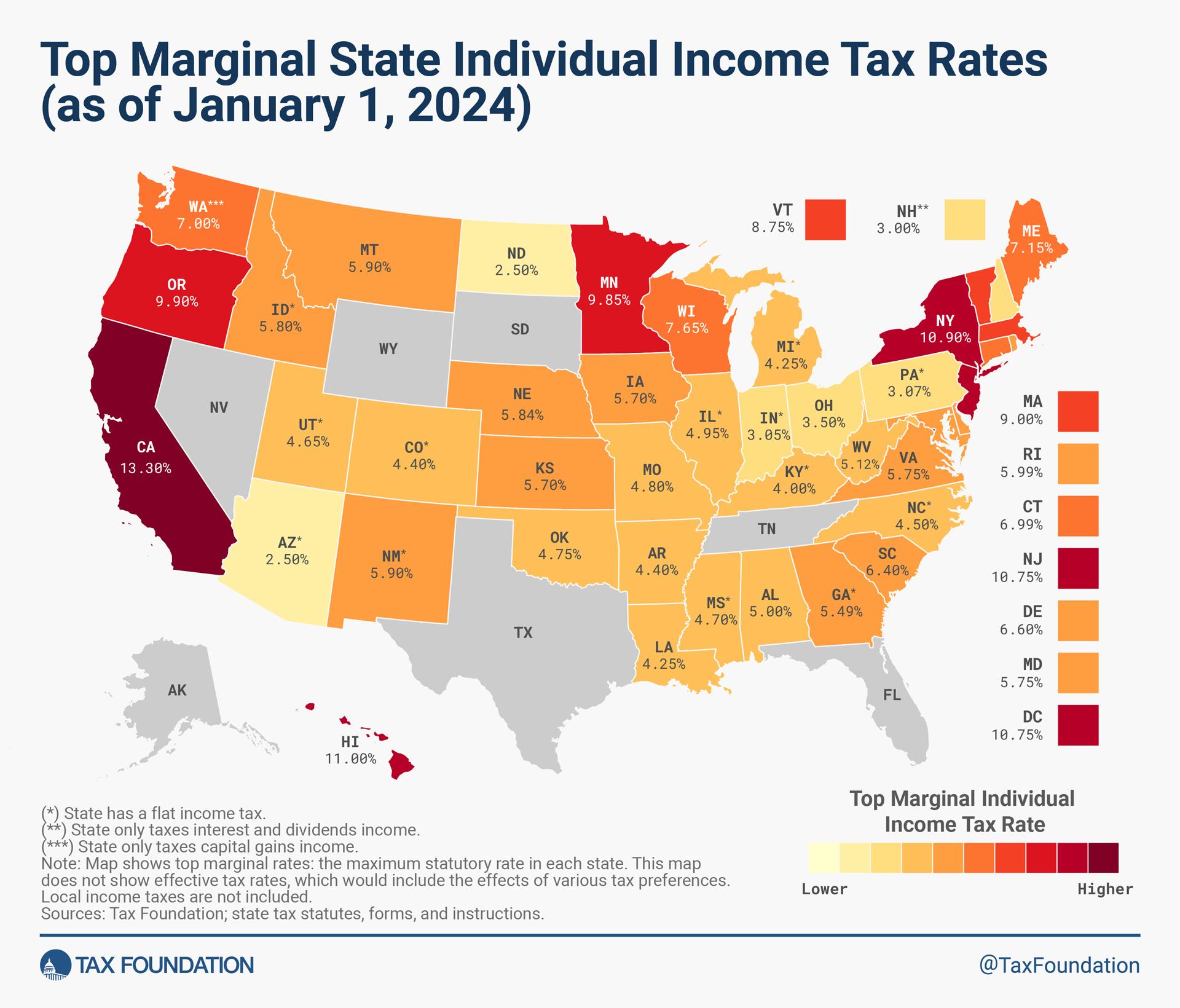

A report released on Tuesday by the venerable Tax Foundation reveals that North Carolina has the lowest individual income tax rates in the South Atlantic Region (and among the lowest individual income tax rates in the nation of the 43 states and the District of Columbia which levy individual income taxes). The South Atlantic Region, according to the United States Census Bureau, is comprised of Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, the District of Columbia, and West Virginia.

“State Individual Income Tax Rates and Brackets, 2024,” authored by Senior Policy Analyst Andrey Yushkov, reports that in the current biennium’s budget, enacted in September 2023, North Carolina accelerated the reduction of its flat individual income tax rate: effective January 1 of this year, the tax rate decreased from 4.75 percent to 4.5 percent. It is scheduled to drop to 3.99% by 2025.

And with the lowest corporate income tax in the nation (among the 45 states and the District of Columbia which collect corporate income taxes), the group ranked North Carolina ninth best in the nation for tax policy in 2023.

Beginning in 2013, the conservative majority in the General Assembly has incrementally the lowered individual income tax rate from a high of 7.75% in 2010 to 4.5% this year. The state’s corporate income tax rate went from a high of 6.9% in 2010 to the current 2.5% and North Carolina is slated to eliminate it entirely by 2030.

Some additional key findings of the Tax Foundation’s report:

- Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax collections in fiscal year 2022, the latest year for which data are available.

- Forty-three states and the District of Columbia levy individual income taxes. Forty-one tax wage and salary income. New Hampshire exclusively taxes dividend and interest income while Washington only taxes capital gains income. Seven states levy no individual income tax at all.

- Among those states taxing wages, 12 have a single-rate tax structure, with one rate applying to all taxable income. Conversely, 29 states and the District of Columbia levy graduated-rate income taxes, with the number of brackets varying widely by state. Hawaii has 12 brackets, the most in the country.

- States’ approaches to income taxes vary in other details as well. Some states double their single-filer bracket widths for married filers to avoid a “marriage penalty.” Some states index tax brackets, exemptions, and deductions for inflation; many others do not. Some states tie their standard deduction and personal exemption to the federal tax code, while others set their own or offer none at all.